The big story in streaming this past week is the anticipated arrival of Amazon's new on-demand music service.

Rumours have been floating around for a while now but sites such as The Verge are guessing that the online retailer could jump into the ring with Spotify and Apple Music etc. over the next few weeks; with a service for customers already using the Echo device.

It is expected they will launch an additional $10-per-month 'open to all' cross-device service in early 2017.

Amazon certainly have a weighty legacy to leverage from, as well as a wealth of recorded media they already offer through their Prime service which they can now bring to the table. But I thought it would be interesting to look at the streaming market as it stands to see just how much of a fight they are going to have on their hands.

Sizing up the competition

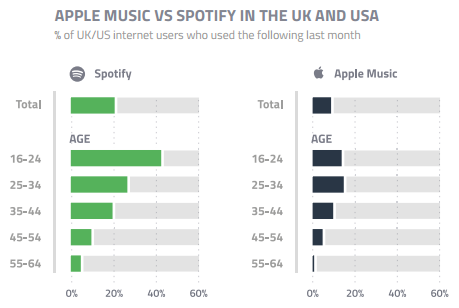

Recent data from GlobalWebIndex finds that 2 in 3 internet users across the US and UK say they are using music streaming services each month. Spotify and Apple Music are dominant, with 20% of internet users using the former and around 10% using the latter.

Spotify's proliferation among younger internet users is significant. It better reflects the lay of the land more generally for the overall market, with 77% of millennials globally using such services according to the same research (GlobalWebIndex's Entertainment Summary for Q3 2016). Young people are certainly the keenest music streamers.

What Amazon can bring to the fight

The initial Amazon streaming service aimed at Echo users certainly looks to add value to the brand's latest audio device.

The option for users to be able to search a bigger catalogue of music than is currently available to Prime subscribers will be a big asset for the device alongside it's voice-activated functionality, its ability to search the web and its quick connection to make orders from the Amazon website.

So we can see Amazon may already be aiming for a different demographic than Spotify, at least initially. Of course, the brand also has in excess of 300 registered users they can quickly target to try out the service – a factor which is especially important with their proposed cross-device service tipped to be launched by early 2017.

As an indication of the hill they need to climb, however, Spotify surpassed 100m users this year and there will no doubt be many Amazon-using music fans already wedded to one of many streaming services available currently.

Distractions and disruptions that might be thrown in the ring

Amazon will certainly be eyeing up Spotify and Apple Music as key competitors, but US internet radio giant Pandora also looks set to jump into the streaming market with a $10 a month service coming off the back of its acquisition of several assets from Rdio late last year.

There could be further significant changes to the landscape too. The Financial Times reported last month that Spotify was in talks with Soundcloud in a move which could see the Swedish company acquire the web platform which is much beloved among independent bands and producers.

If the deal between Spotify and Soundcloud comes off, we can expect a massive jump in the size of the Spotify library (which already boasts more than 30m tracks) and an interesting development in the increasingly democratised landscape of independent music publishing.

Outcomes?

It's an interesting time for music consumers. We can see that Amazon is seeking to give users a number of options for purchasing and listening to new music and their Echo device will be the place in which these are consolidated – at least, for users who want a home-based system.

By next year, we can expect that Amazon's more universal streaming service will be aiming to entice users who may not want the Echo device, but who know the brand and are keen to try streaming out.

It's not too far-fetched to guess that certain demographics may well be more trusting of the Amazon name than they are of Spotify. And we can expect the brand to tap into its vast (and diverse) existing membership to promote its new services.

Spotify and Apple Music will not be easy to compete with, however. Both services are still seeing significant membership growth and we can expect additions to their respective assets in 2017 which will likely prove positive for the platforms and for the consumers who use them.

No comments:

Post a Comment